What really matters when it comes to financial wellbeing?

Emily Ross

Widely regarded as a global pioneer of financial capability and financial wellbeing research, Elaine Kempson, Professor Emeritus of Personal Finance and Social Policy Research at the University of Bristol discusses ANZ’s latest Financial Wellbeing survey of adults in New Zealand.

Emily Ross: I wanted to ask you to highlight some of the things that you think have been particularly interesting, or that other people might find surprising about these Financial Wellbeing surveys.

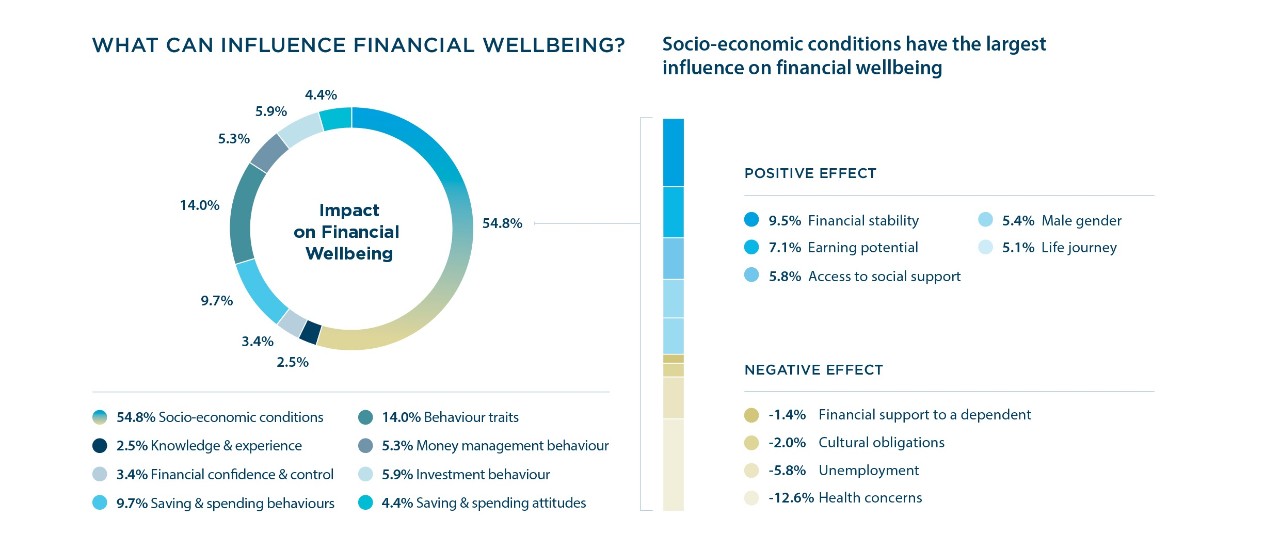

Elaine Kempson: I think what people in the financial education world are going to find very interesting and quite challenging, is the extent to which socio-economic, particularly economic, factors play a huge role in financial wellbeing. And also the relatively limited role that knowledge plays – that behaviours are much more important.

I think the flip side of that though is the people who work in the anti-poverty lobby may be surprised that actually behaviours can make a difference, even on a relatively low income.

What you do with your money can make a situation better or worse.

I've long said that financial wellbeing is a combination of two factors, it's how much money you've got, and it's what you do with the money you have got. I think this survey shows that very, very clearly.

Is there a particular economic factor that resonates for you?

Ultimately, it all comes down to income, and things that disrupt income.

And what I thought was really nice about this analysis is that it shows us that people with problems relating to health, mental health, unstable employment and not just unemployment but also all those people who work in the gig economy, those are the people that are really at risk.

"Financial wellbeing is a combination of two factors. It's how much money you've got and it's what you do with the money you have got."

Elaine Kempson, Professor Emeritus, Personal Finance Research Centre, University of Bristol.

In comparison with other countries/regions who are researching financial wellbeing, how are the Kiwis and Aussies going? What are they good at, where do they lag behind?

What I love about the work you've just done is that you've used leading edge statistical modelling. And that's made a huge contribution to our understanding.

It really enables us to assess the overall effects of all the individual factors, both their indirect effects as well as the direct ones and that's an enormous step forward.

The other thing which I think you've really done well and moved things forward a lot is by grouping all those large numbers of socio-economic factors – age, gender, health status, employment status – and grouped them.

Again it's statistical techniques, but it enables them to be included in this modelling and that's again really furthered our understanding.

In a way, once you see the socio-economic factors inside the model, you think ‘how could they have quantified it before’?

Yes, you couldn't quantify it before. It's only by using this statistical technique, which only a handful of people can do to be honest, and they've done it very well indeed. It has really furthered our understanding.

So this really is groundbreaking.

So how is New Zealand going?

I think we are all struggling through the pandemic and we must expect to see things go into reverse and financial well-being fall.

Some people have been really very badly hit by the pandemic so we can do all the things we can to change behaviours but if people's incomes have been hit hard, it’s back to that same thing.

It's a balance between the money you've got and what do you do with it. You can manage it better, but if the amount of money you've got has fallen, then your wellbeing is almost certainly going to be lower.

You can see in this latest data and research that the insights that are coming out are very different from the original model that you proposed.

As a trained scientist I am very happy to have models negated, refined and developed. We've seen it through this pandemic with health research on COVID, that as more evidence becomes available so we adapt what we're doing. That's exactly what we need to do with this model of financial wellbeing.

There are some quite fundamental personality traits that lead people to manage their money in the way that they do – from your research, what are the riskiest ones? (e.g. time orientation, self-control, inertia?)

I would say the two most important ones are time orientation and self-control. Time orientation very much determines whether you've got a future focus or not.

Whether you put money aside just in case. Whether you're planning for your future wellbeing.

And self-control has got a huge amount to do with how well you manage your money day to day.

What are the most important ways that you would like to see this growing and evolving body of financial wellbeing research influence policy, regulators and lead bodies?

I want policymakers to recognise that tackling poverty and inequality is really vitally important to the wellbeing of the population. And you can't leave it all to education and behaviour change.

Income matters, but actually within that there is so much more we can do to help individuals to make the most of the money they have.

After all, not everybody who loses their job ends up in serious financial difficulty. We understand from this work what it is that makes the difference between keeping your head just above water and going right under.

So we need to move on from the idea that greater knowledge is the most important thing, and we need to learn from the techniques that have long been used in health and public health to bring about behaviour change.

And we've seen that, there are lots of lessons we can learn from the pandemic about how people will change their behaviour.

If you had to ask someone just one question to understand their financial wellbeing, what would you ask them?

Yeah, well actually, I think there are probably two questions. First I would ask them about their ability to pay their bills on time. That's really the sharp end of it all. If you can't pay your bills on time, then you won't have any financial resilience either.

But in terms of what determines your financial wellbeing. I would ask about financial locus of control because it affects so many of the behaviours that affect financial wellbeing.

And in terms of what's determining financial wellbeing, I suppose maybe a third question would be level of income. If you knew those three things you'd know a lot.

RELATED ARTICLES

NZ Insights

Supporting women to succeed

NZ Consumer