Inside ANZ

Virtual first home buying... say what?

“Our first home buyers needed more help than ever to ensure they are confident throughout the process of what is considered a major life milestone” Mark Haynes, ANZ Home and Lending Associate.

Brianne works in the ANZ communication team and has shared her and her partner’s journey of becoming a first home buyer – amid a pandemic.

Earlier this year, I shared my journey of becoming a first home-buyer. Needless to say, amid the global pandemic navigating the housing market for the first time was an interesting experience.

Fast forward six months and the experience has become… virtual.

Since COVID-19 there has been constant change in the way we go about our everyday activities, and in the world of home buying, online housing auctions, video inspections and virtual meetings have become the norm.

I recently caught up with the team at the Chadstone Home Centre to find out more about how they are adjusting to new ways of doing things and learn about the new virtual First Home Buying seminars designed to educate and guide first home buyers through the process.

Mark Haynes, ANZ Home and Lending Associate says it’s important for our customers to know they have support through the whole journey.

“From day one through to settlement, we can help customers. From setting up savings, arranging deposits and providing them with industry wide information, we help them navigate their first major purchase, a home!”

Before and after

On any given day pre-COVID you’d find small groups of 15-20 people gathered in Chadstone’s Home Centre for a First Home Buying seminar. From my experience, the ambience and overall atmosphere of the Centre created the impression of sitting in someone’s home - crackling gas fireplace, warm colours and plush couches.

It definitely helped me feel more comfortable, confident and at ease while on the brink of such a major milestone.

Mark described the face-to-face sessions as practical and involved - offering customers personalised service, where they could feel comfortable.

“Anyone could talk to any of our first home coaches or ask questions face-to-face at the seminars,” Mark says.

Industry experts such as conveyancers, solicitors or real estate agents, offered their expertise and provided a holistic approach to the home buying journey.

Fun fact: The most commonly asked question from first home buyers is…

What is a pre-approval and how do I start the pre-approval process?

For more information, see Buying your first home.

As weeks, turned into months through Victoria’s Stage 4 lockdown, Mark says the team felt a sense of helplessness for many first home buyers.

Restrictions were in place, auctions were going online and inspections were being conducted virtually.

“As we ushered in the new COVID normal, we had to adapt and change how we approached things for everyone’s safety. Our first home buyers needed more help than ever to ensure they felt confident throughout the process,” Mark says.

So the Chadstone Home team decided to pilot a one hour virtual First Home Buyer’s session initially with ANZ staff. Run virtually via Microsoft Teams, the sessions which included advice from industry experts and ended with time for questions have now been extended to customers and the general public.

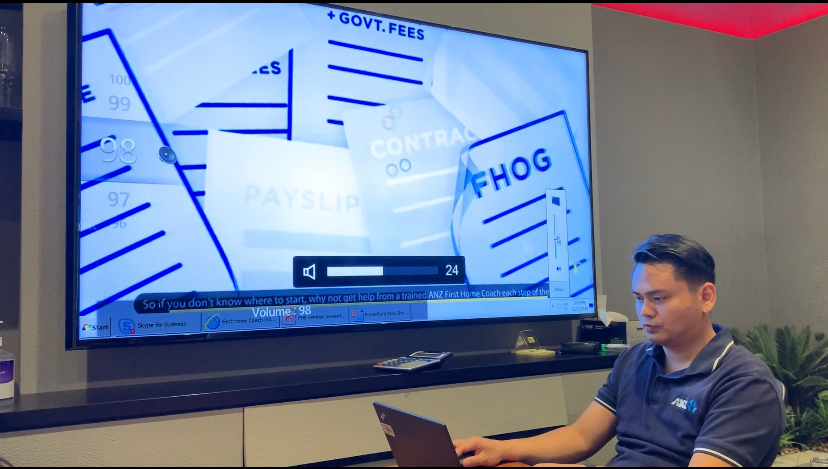

Mark Haynes, ANZ Home and Lending Associate running an online, virtual seminar for first home buyers.

“We knew the dynamics would be different online. But we still provide all the information our customers want and need,” Mark says. “It did take some getting used to, as I am a little camera shy.”

Virtual signing

The banking industry is embracing the move to digital signing for mortgage and other documents, with regulatory reforms fast-tracking changes during the pandemic - eliminating paperwork for the bank and customers, reducing cost and time and improving security.

ANZ is also ensuring social distancing and limiting face-to-face contact with customers and bankers to keep everyone safe through:

ANZ eSign- electronic signature and acceptance of ANZ Home Loan documents; removing the need for customers to attend branches or wait for documents to be sent in the mail.

ANZ eVerify - electronic verification of customer identification to support the bank’s Anti-Money Laundering and Counter-Terrorism Financing (AML/ CTF) obligations, where we are required to verify customer’s identification. This requirement must be completed in person prior to a customer settling their ANZ Home Loan. This new solution also enables both biometric and electronic verification of customer photos and documents and typically takes under three minutes for a customer to complete on their mobile device.

The Australian dream

The team can’t wait to see what the new year will bring and is optimistic about the virtual journey.

” We know with all first home buying experiences, the real joy comes when our clients achieve their Australian dream of buying their first home and collecting the keys!” Mark says.

“What I love is following each person’s journey in becoming a home owner as we all come from different backgrounds and professions but want to achieve the same goal.”

And while doing it virtually is a little less traditional, the journey is still just as, if not more, exciting!

RELATED ARTICLES

Customers

Organising your home (loan)

Home & Business Ownership